Garaging misrepresentation isn’t a fib—it’s fraud

Incorrect garaging information can significantly affect both the insurer and the insured, leading to premium leakage, coverage issues, financial losses, and regulatory action.

Close the door on garaging fraud

Boost pricing accuracy and minimize premium leakage at point of sale and renewal, ensuring policies are correctly written and priced for ongoing rate integrity.

Uncover the truth

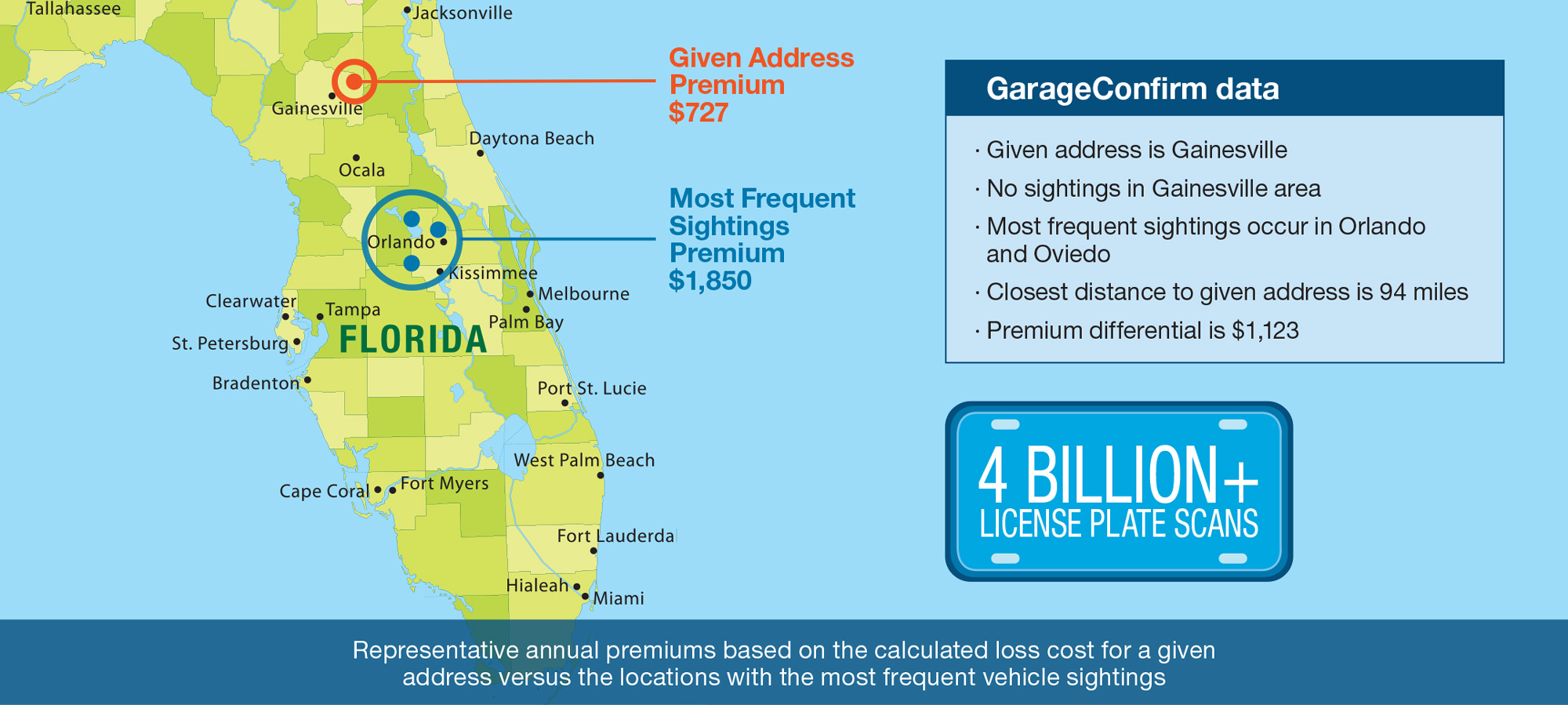

Leverage a rich database of 4B+ license plate sightings from 75% of the nation to identify time, frequency, and proximity relative to a given garaging address.

Plug the leaks

See the complete picture: Garaging location and commuting mileage can result in extreme premium differentials.

Cover your bases

Ensure drivers have the appropriate in-state policy to avoid discrepancies in PIP, medical, minimum limits, and other provisions.

How GarageConfirm Works

GarageConfirm tracks vehicle locations relative to listed addresses, creating location-based loss cost and premium differentials by analyzing geospatial clusters of recent sightings.

Features and capabilities

Fraud detection

Recover potential lost premium at point-of-sale and renewal by confirming reported addresses and commuting mileage.

Location-based insights

Generate loss costs and premium differential for top-three vehicle sighting locations with access to 4B+ records.

Unmatched data

Tap into the largest database of license plate sightings, spanning 75% of the nation and previously available only to law enforcement and lenders.

Do more with the Verisk ecosystem

Future-proof your business with a partner that puts you in the driver’s seat.

Rating integrity at every stage

Harness data-driven analytics to detect fraud and take on premium leakage across the policy life cycle.

Mileage verification

Leverage the strong link between mileage and claims to strengthen your underwriting and rating.

Vehicle radius and territory

Confront premium leakage due to radius and territory misclassification.

Modernized, data-forward quoting

Accelerate data-forward quoting and modernize buying journeys to keep more business in the pipeline and boost conversion rates.

Public records insights

Upgrade your MVR solution with more than 2 billion court records and over 300 million crash records for a clearer picture of driver risk.

Coverage history and details

Gain a chronological, 360-degree view of risk, unlock predictive behavioral patterns, and discover multiple use cases.

* Updated 2022 estimate based on Coalition Against Insurance Fraud’s The Impact of Insurance Fraud on the U.S. Economy, pages 23-26, applying overall annual premium leakage increase to Verisk’s estimate from The Challenge of Auto Insurance Premium Leakage, 2017.