Catastrophe and Risk

Catastrophe Risk Models

When catastrophic events threaten billions in exposure, risk modeling provides the clarity insurers, reinsurers, and brokers need to make confident decisions. Natural perils like hurricanes, earthquakes, and severe thunderstorms—alongside man-made events such as terrorism—demand scientifically rigorous catastrophe risk models that reflect near-present climate realities and evolving threat landscapes. Verisk's insurance risk models deliver the trusted foundation for decisions across the entire risk lifecycle.

Four decades of scientific leadership in catastrophe modeling

We pioneered catastrophe risk modeling in 1987, establishing the foundation for how the insurance industry quantifies and manages extreme event exposure. For nearly 40 years, Verisk has developed probabilistic models that help more than 400 organizations prepare for the financial impacts of catastrophes before they occur. Today, our insurance risk models assess the likelihood and severity of loss from catastrophes across more than 120 countries and territories worldwide, supporting decisions measured in billions of dollars.

Comprehensive risk modeling tools for every major peril

From hurricanes intensifying in unexpected patterns to wildfires raging outside historical zones, extreme events are evolving faster than ever. Our catastrophe risk models span natural and man-made perils, delivering the granular insights you need to understand exposure across your entire portfolio.

Hurricane and Tropical Cyclone Models

North Atlantic basin, Pacific typhoons, and global tropical cyclone risk with storm surge modeling

Wildfire Models

Wildland-urban interface risk reflecting vegetation dynamics and climate-driven expansion

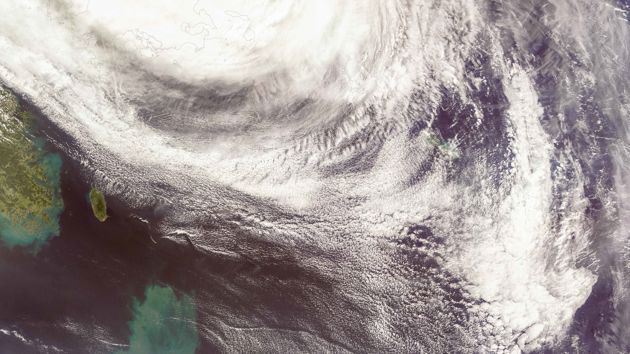

Extratropical Cyclone Models

Risk assessment for snow, ice, and freeze damage from a single winter storm or a cluster of storms

Agricultural Risk Models

Comprehensive analyses of historical yield, price, and loss data for crops, forests, and livestock

Climate Risk Solutions

Understand risks and losses from physical and liability aspects of changing weather

Strikes, Riots, and Civil Commotion (SRCC) Risk Model

Estimate losses related to damage and business interruption from fire, looting, and vandalism

Validated with proprietary data, trusted by industry leaders

Catastrophe modeling is the foundation of billions of dollars in risk transfer decisions. When models become the currency of risk, trust is critical. That's why we continuously validate and calibrate our risk modeling tools with proprietary, verified historical data spanning more than $130 billion in detailed claims and $370 billion in aggregate loss data.

Our models reflect the latest scientific research, extensive observational data, and engineering knowledge—ensuring outputs aligned with real-world outcomes to support underwriting and pricing with confidence in exposure assessment; capital optimization and efficient allocation; regulatory, rating agency, and internal capital adequacy compliance; reinsurance program structuring and insurance-linked securities evaluation; and portfolio management across complex, multi-peril exposures.